Articles

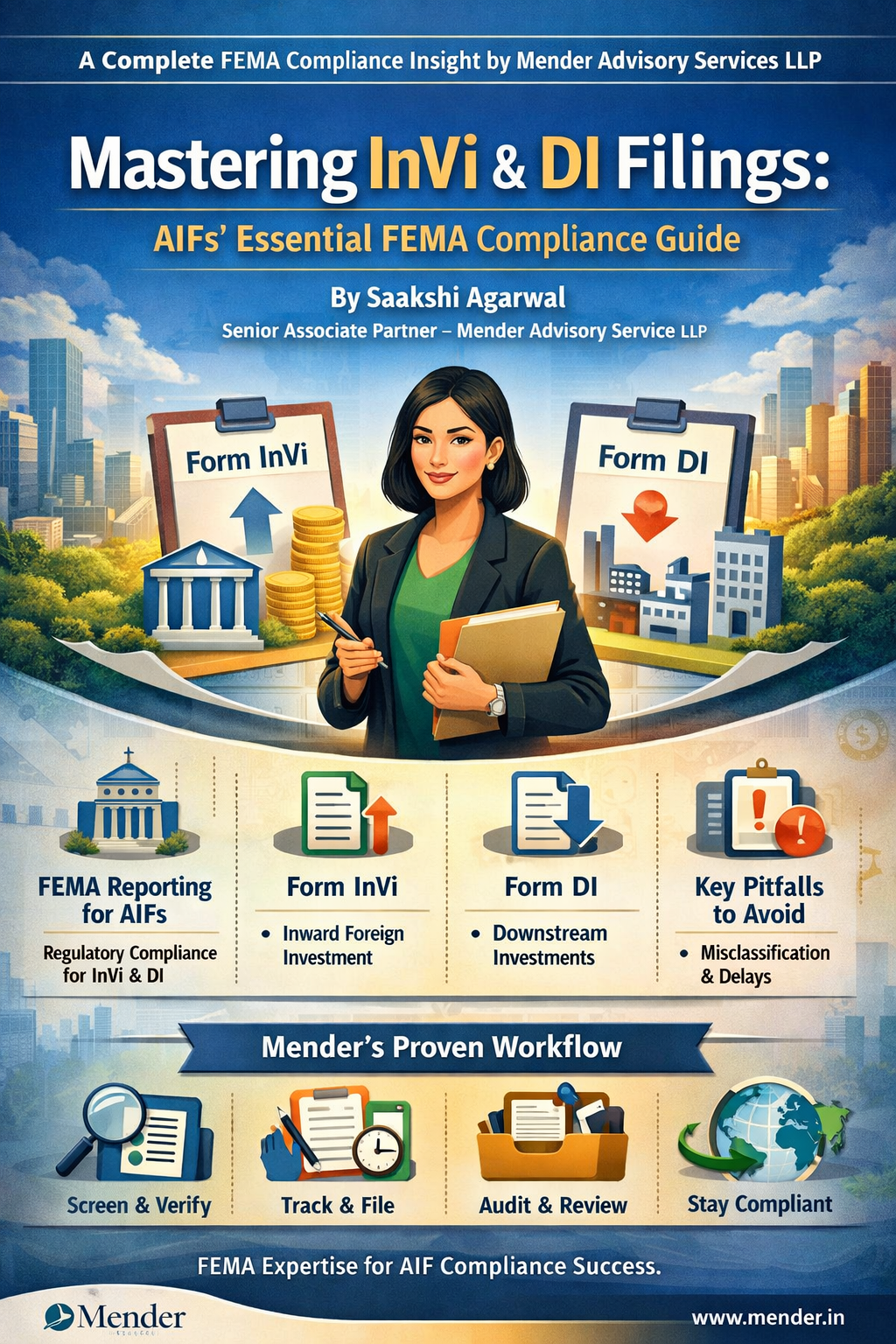

Mastering InVi & DI Filings

At a glance

Forms InVi and DI are mandatory FEMA filings for AIFs on the RBI FIRMS portal. InVi reports foreign inflow into the AIF; DI reports downstream investment by a foreign-owned/controlled (FOCC) AIF into Indian entities. Both are generally time-bound (often within 30 days) and delays may trigger Late Submission Fee (LSF).

Introduction

Foreign investment into Alternative Investment Funds (AIFs) in India is rising steadily. Along with opportunity comes a clear compliance obligation: FEMA reporting on the RBI FIRMS portal. Two filings matter most for AIFs and their managers—Form InVi and Form DI.

Why FEMA reporting matters for AIFs

AIFs receiving foreign investment are governed by the FEMA (Non-Debt Instruments) Rules, 2019 and related RBI reporting directions. Accurate and timely reporting:

-

demonstrates regulatory discipline and governance maturity to global LPs and investors

-

reduces the risk of Late Submission Fee (LSF) and other FEMA contraventions

-

supports smooth downstream transactions by maintaining a clean compliance trail

-

aligns fund reporting with investee-company documentation and sectoral compliance checks

Form InVi: foreign investment into the AIF

Form InVi is filed when an AIF issues/allocates units to non-resident investors—including new commitments, capital top-ups and unit allotments pursuant to drawdowns/capital calls.

-

Filed by: AIF / Investment Vehicle

-

Timeline: generally within 30 days of unit allotment (as applicable under FIRMS reporting)

-

Typically required: investor KYC, FIRC/SWIFT or equivalent remittance proof, allotment details and supporting declarations

-

Risk of delay: Late Submission Fee (LSF) and compliance follow-ups

Form DI: downstream investment by the AIF

Form DI is triggered when a FOCC AIF makes a downstream investment into an Indian company or LLP. The filing enables RBI to track indirect foreign investment and confirm sectoral conditions and reporting consistency.

-

Filed by: AIF (downstream investor)

-

Timeline: generally within 30 days of allotment / investment (as applicable under FIRMS reporting)

-

Typically required: CIN/LLPIN of investee, sector/activity, instrument and valuation details, and approvals where relevant

-

Purpose: tracks indirect FDI and checks sectoral compliance

InVi vs DI: quick comparison

| Parameter | Form InVi | Form DI |

|---|---|---|

| What it reports | Foreign inflow into the AIF (unit allotment to non-residents) | Downstream investment by FOCC AIF into Indian entity |

| Trigger | Non-resident investor unit allotment / drawdown | AIF invests in Indian company/LLP |

| Filed on | RBI FIRMS portal | RBI FIRMS portal |

| Timeline | Generally within 30 days | Generally within 30 days |

Common pitfalls to avoid

-

Misclassifying investor residency or investor category

-

Incorrect FOCC evaluation due to fresh LP commitments or changes in control

-

Mismatch between remittance details (FIRC/SWIFT) and allotment records

-

SEBI vs RBI reporting inconsistencies (same transaction, different data points)

-

Overlooking sectoral caps/conditionalities at the investee level during downstream investment

Mender’s recommended workflow

A simple, repeatable workflow keeps your fund and investee companies compliant:

-

Pre-investment hygiene: Screen LPs, capture KYC early, and model FOCC on an ongoing basis.

-

Trigger tracking: Maintain an internal tracker for allotments, drawdowns and downstream investments.

-

Document pack: Collate remittance proofs, allotment notes, valuation/transaction documents and declarations per transaction.

-

FIRMS filing + audit trail: File on FIRMS with a maker-checker review, maintain an audit trail, and review FOCC and filing status periodically (including annual FLA, as applicable).

Final thoughts

With rising global participation in India’s AIF ecosystem, disciplined FEMA reporting is no longer a back-office formality—it is a trust signal. Strong InVi/DI practices reduce regulatory risk and increase investor confidence. Mender Advisory supports AIFs with end-to-end InVi and DI filings, FOCC evaluation, and FEMA audit assistance—so funds can focus on investment strategy while staying compliance-ready.

Connect with Mender Advisory Services LLP via www.mender.in Email saakshi@mender.in

© Mender Advisory Services LLP | www.mender.in